How to Find Flexible Budget Variance

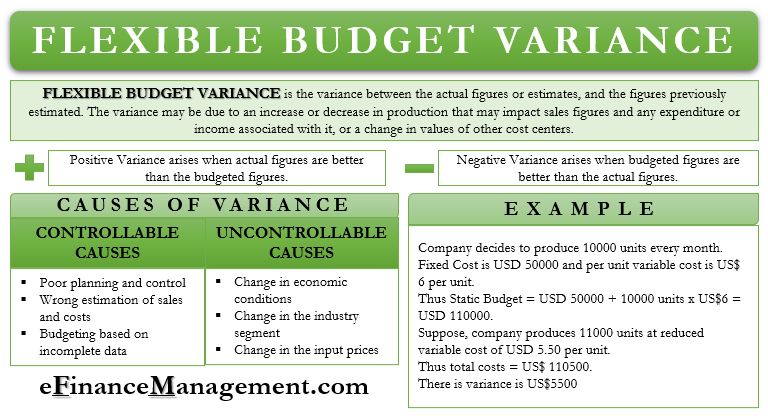

If you manage a high-level production environment creating a flexible budget can help mitigate the typical variances found on static budgets. A flexible budget variance is any difference between the results generated by a flexible budget model and actual results.

For example a flexible budget model is designed where the price per unit is expected to be 100.

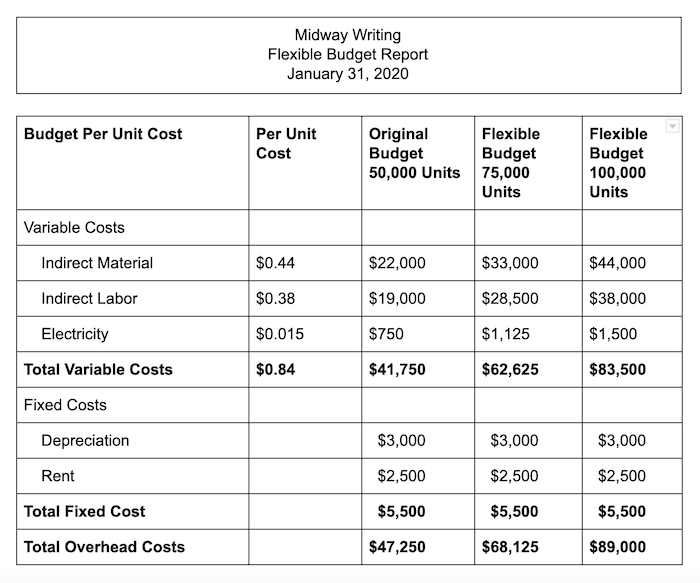

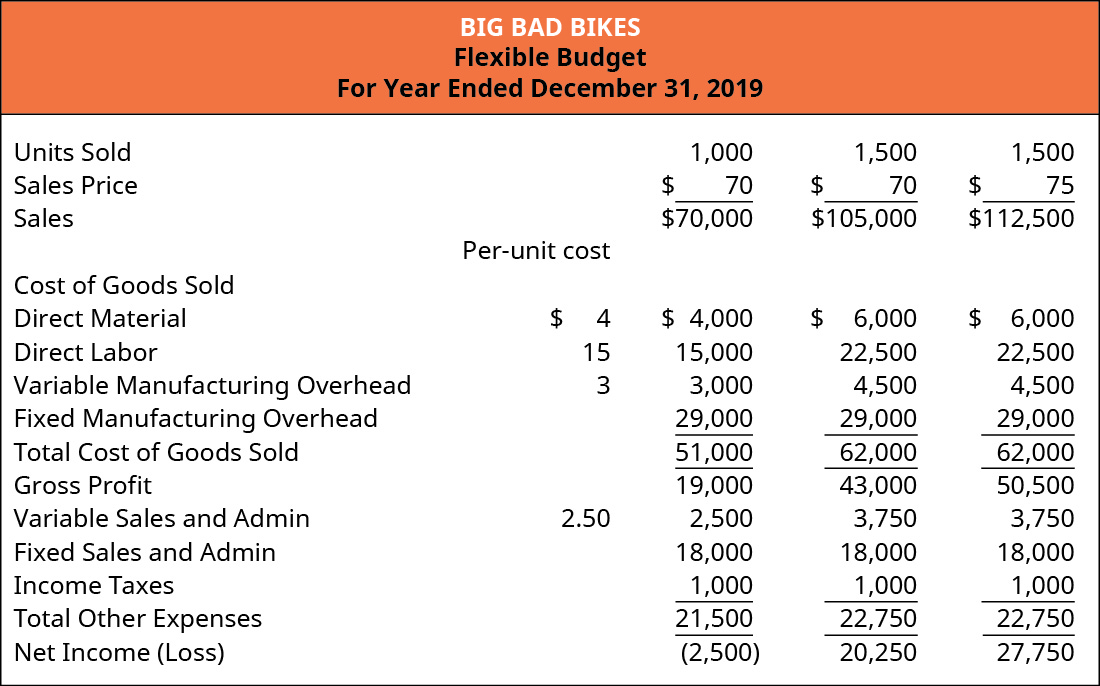

. A flexible budget on the other hand would allow management to adjust their expectations in the budget for both changes in costs and revenue that would occur from the loss of the potential client. As an example take a company with a master budget that projects production of 10000. A flexible budget adjusts the master budget for your actual sales or production volume.

Unlike the static budget a flexible budget for the shipping department will increase when more than 50000 items for the year are. The first is the positive convention which measures variance as a positive value but a negative variance negative figures indicate actual figures. Less revenue is generated or more costs incurred.

These are added to the fixed costs of 12500 to get the flexible budget amount of 24750. Flexible Budget Formula Example. While access to digital dashboards actual variance analysis modules and other best-in-class budgeting tools help the basic formula for obtaining the data necessary to a budget variance analysis boils down to two simple formulae.

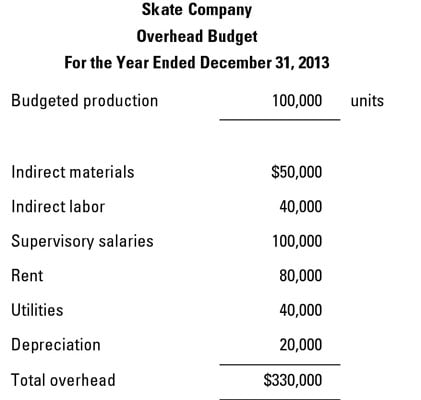

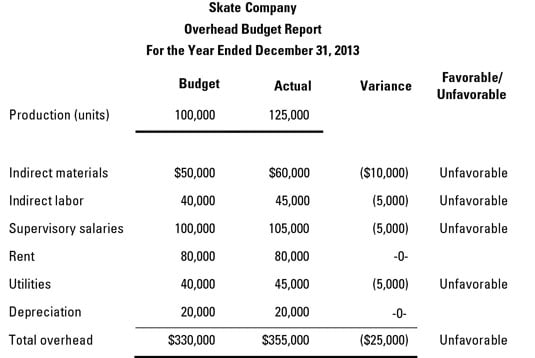

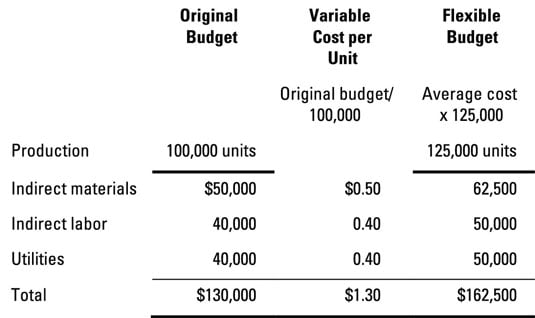

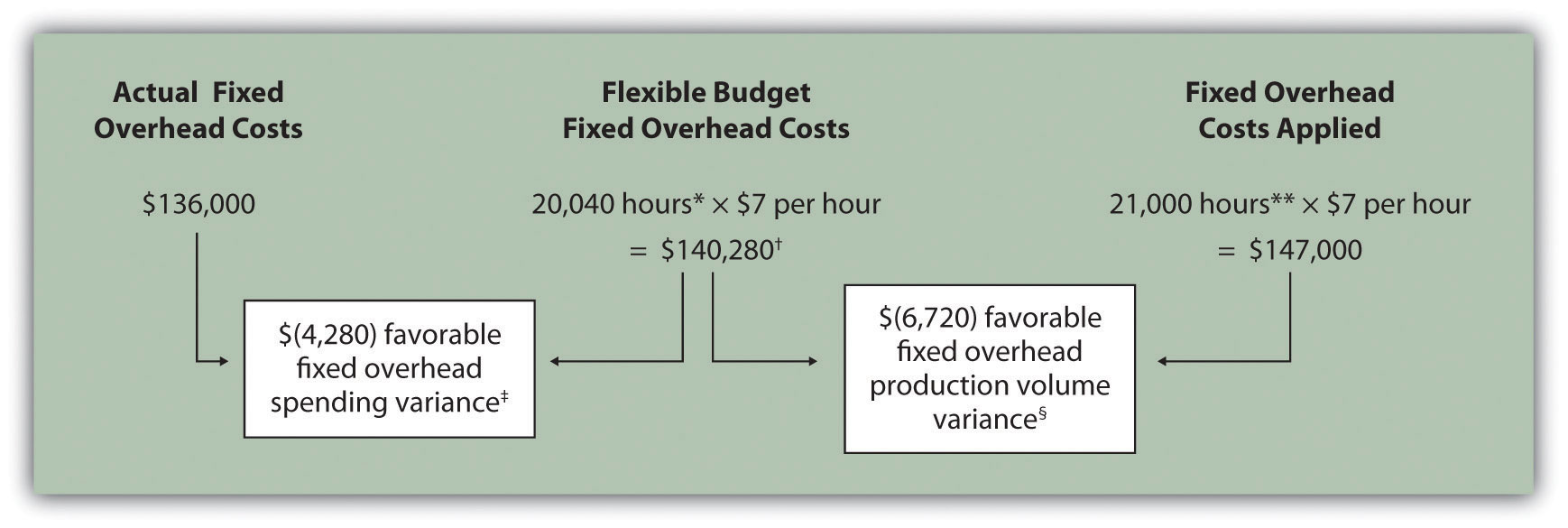

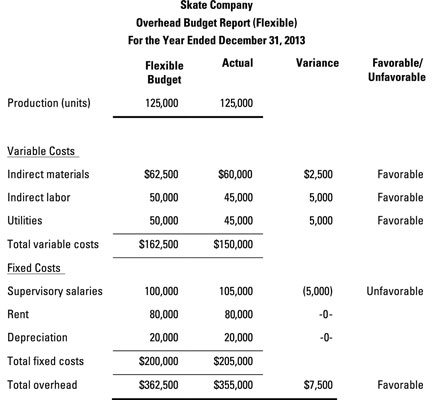

Fixed overhead budget variance budgeted fixed overhead actual fixed overhead Fixed overhead budget variance 19000 17500 1500 F With the result above we can conclude that the 1500 of the fixed overhead budget variance is favorable in which it means that the company ABC spends less than the budgeted cost in this area by 1500 in the month. A summary of the departments static budget based on shipping 50000 items is. Notice how the variable costs change with.

Fixed expenses salaries utilities etc of 350000 variable expenses cartons helpers etc of 150000 50000 items X 3 each total static budget of 500000. You are required to prepare a flexible budget at actual level of output and calculate flexible budget variances. There are two main reasons for a companys actual performance to be different from.

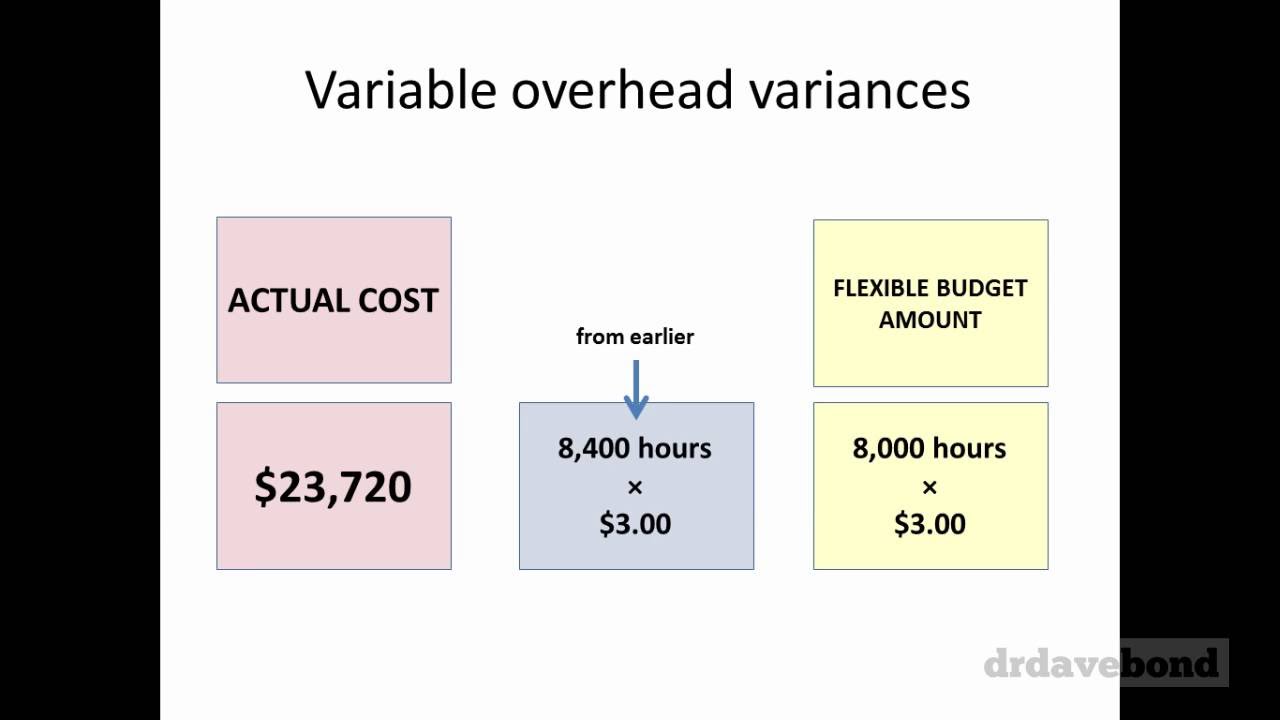

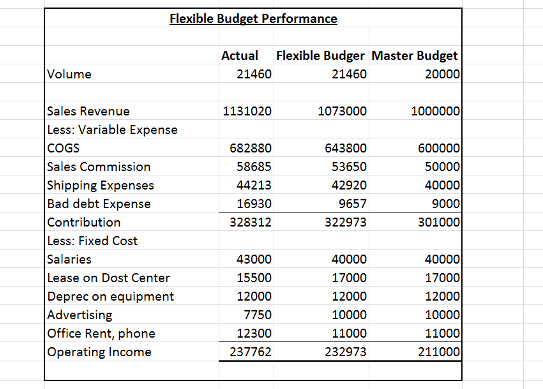

In the following paragraphs we will break down each of the formulas in more detail. To determine the flexible budget amount the two variable costs need to be updated. Since revenues and variable costs vary directly with number of units we need to calculate budgeted price and variable costs per unit by dividing static budget amounts by 30000 budgeted units.

To calculate a static budget variance simply subtract the actual spend from the planned budget for each line item over the given time. However you actually produce 5100 units. Unfavorable variances are the opposite.

This 15000F variance is due to lower activity. As the name implies the percent variance formula calculates the percentage difference between a forecast and an actual result. Example of a Flexible Budget Variance.

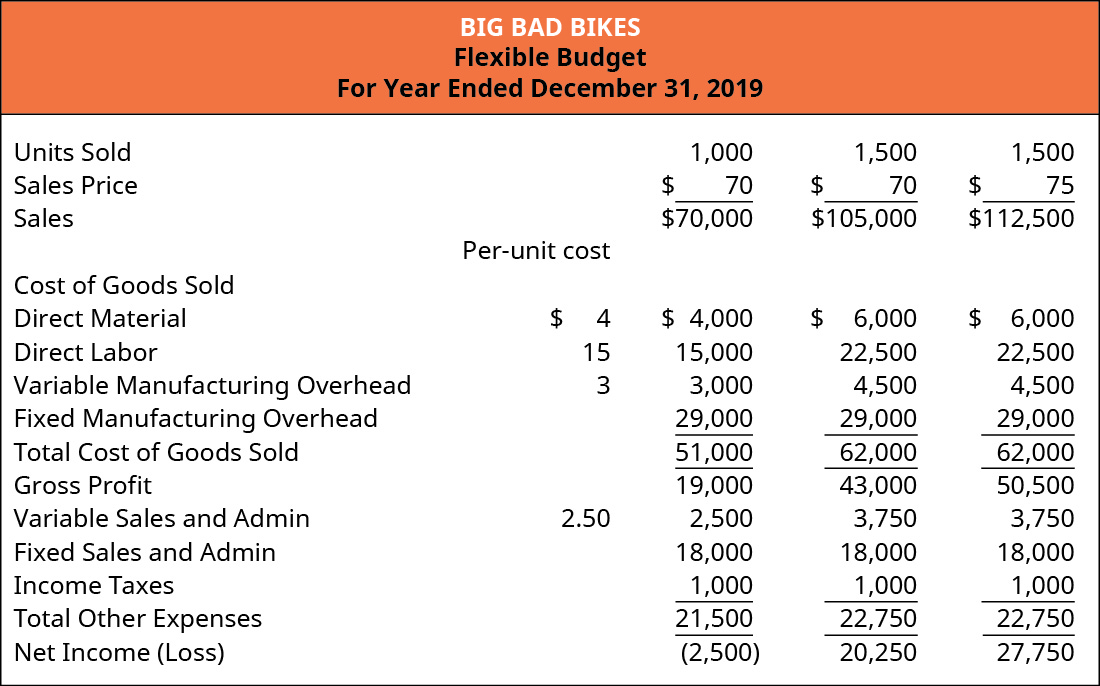

Keeppp fixed costs the same and compute flexible-budget variances. How to Calculate Flexible-Budget Variance Types of Flexible Budget Variances. The flexible budget example below displays both the original static budget amount as well as a flexible budget based on increased production levels.

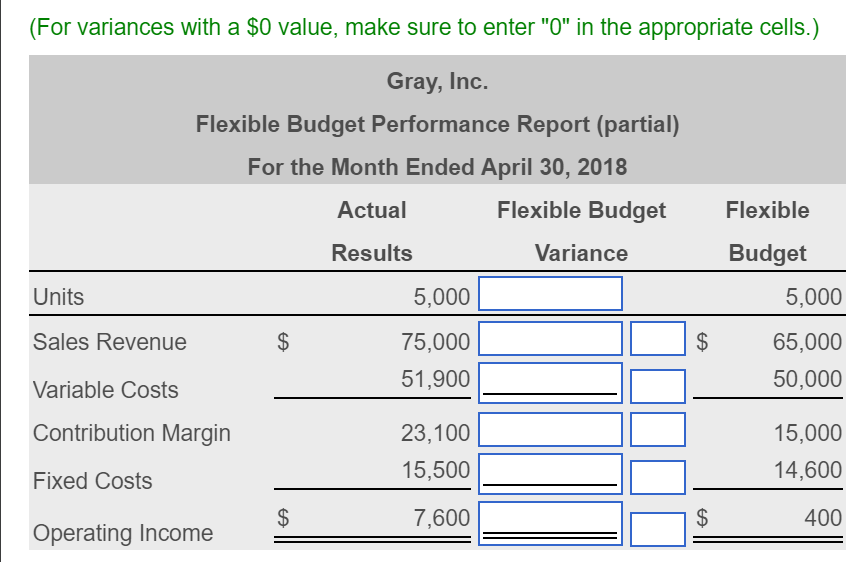

We will work example problems related to flexible budgets and provide step by step instructional videos to apply the concepts. Flexible-budget variance Æthe difference between an actual result and a flexible-budget amount sales-volume variances Æeach sales-volume variance is the difference. Leed Company prepares a flexible budget for 70 80 90 and 100 capacity.

The course will define and analyze standard costs and cost variance analysis giving an overview of cost variance analysis concepts that we will go into more detail on in later sections. Specifically direct material direct labour. In the most recent month 800 units are sold and the actual price per unit sold is 102.

This 3350U variance is due to poor cost control. Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected. Static Flexible Actual Overhead Overhead Overhead Budget at Budget at at 10000 Hours 8000 Hours 8000 Hours 7400089000 77350 Flexible Budget Performance Report 6.

Either may be good or bad as these variances are based on a budgeted amount. We can calculate the flexible budget for any level of activity using these figures. This means there is a favorable flexible budget variance related to revenue of 1600 calculated as 800 units x 2 per unit.

We will work example problems related to flexible budgets and provide step by step instructional videos to apply the concepts. Now that we know the variable costs per unit. This video provides an overview of the calculation of flexible budget variances for variable manufacturing costs.

The course will define and analyze standard costs and cost variance analysis giving an overview of cost variance analysis concepts that we will go into more detail on in later sections. Variance Actual Forecast. There are two formulas to calculate variance.

Develop a flexible budget. Here is the flexible budget as a reminder. SALES-VOLUME CONTRIBITION MARGIN VARIANCE The sales-volume variance shows the effect of the difference between actual and budgeted quantity of the variable used to flex the flexible budget Formula Sales-volume CM variance Actual qty Static-budget qty X Budgeted CMunit.

Variance Actual Forecast 1. For example your master budget may have assumed that youd produce 5000 units. The changes made in the flexible budget would then be compared to what actually occurs to result in more realistic and representative variance.

Typically actual revenues or actual units sold are inserted into a flexible budget model and budgeted expense levels are automatically generated by the model based on formulas that are set at a percentage of sales. The new budget for sales commissions is 10500 262500 sales times 4 and the new budget for delivery expense is 1750 17500 units times 10. Proportionately increase variable costs.

Demonstration on how to make a flexible budget how to compute a sales volume variance and a flexible budget variance. LEVEL 2 CONTRIBUTION MARGIN VARIANCE CALCULATION. To compute variances that can help you understand why actual results differed from your expectations creating a flexible budget is helpful.

How To Implement A Flexible Budget Dummies

How To Implement A Flexible Budget Dummies

Flexible Budget Variances Variable Manufacturing Costs Youtube

How To Implement A Flexible Budget Dummies

Solved Begin With The Flexible Budget Variance Column Chegg Com

Fixed Manufacturing Overhead Variance Analysis

A Small Business Guide To Flexible Budgets The Blueprint

Static Budget Variances Managerial Accounting Youtube

Solved This Analysis Of Flexible And Static Budget Variance Chegg Com

What Are The Advantages Of Using A Flexible Budget Vs A Static Budget Better This World

Static Budget Variance Youtube

Solved Complete The Flexible Budget Variance Analysis By Chegg Com

Flexible Budget Variance Youtube

Solved White Pro Company Flexible Budget Performance Report Chegg Com

Prepare Flexible Budgets Principles Of Accounting Volume 2 Managerial Accounting

Solved 9 Answer The Following Questions A What Is The Chegg Com

How To Prepare A Flexible Budget Accounting Financial Tax

Comments

Post a Comment